How a 27-year-old lives on $88,000 a year in the Bay Area

If Amazon doesn't have a Whole Foods grocery near you, there are non-perishable groceries ( food that doesn't spoil) that Amazon can ship to you

This story is part of CNBC Make It’s Millennial Money series, which profiles people across the U.S. and details how they earn, spend and save their money.

Christine Hopkins wasn’t always responsible with money.

The 27-year-old, who earns $88,000 a year as a marketing manager in the Bay Area, spent several years charging flights, clothes and nights out to her credit card without having the means to pay it off. “I always just assumed that credit cards were there to buy things you wanted and then you figure out how to pay for them later,” she tells CNBC Make It.

But in 2018, she began to feel trapped by her debt. “No matter how much more in salary I was making, I was still living paycheck to paycheck, which wasn’t making sense to me,” she says. “I thought, ‘Where is all of my money going? Why is this happening to me?'”

On top of all the debt, Hopkins had almost nothing in savings, and she started to worry about what she would do if she lost her job because the cost of living is so high in the Bay Area.

No matter how much more in salary I was making, I was still living paycheck to paycheck, which wasn’t making sense to me.

She decided to make a concerted effort to change her habits and started working with a professional financial advisor in February. Her effort is already paying off: Hopkins now puts nearly $2,000 a month into savings, diligently pays down her debt and still enjoys a full life in the Bay Area, from beach days with her two dogs to exploring bars and breweries with her partner.

Although a significant portion of her earnings goes toward rent and debt repayment, Hopkins says she never feels like she’s struggling to get by. “I’m able to live pretty comfortably on my salary in Berkeley,” she says.

Here’s a look at how Hopkins earns, spends and saves her money.

What she earns

Hopkins works as a marketing campaign manager at Bluewolf, an IBM company, where she earns $88,000 per year. She lives in the East Bay, in Berkeley, but commutes into downtown San Francisco for work.

Hopkins first started working in the Bay Area as a marketing intern earning $15 an hour the summer after she graduated from college. At the end of her internship, the company offered her a full-time position for $50,000 a year. As she’s gained experience and changed jobs a few times, her salary has steadily increased.

Christine Hopkins in Berkeley, California.

CNBC Make It

When Hopkins realized that her debt had not decreased despite her growing salary, she began working with a financial advisor at the Financial Gym. It was eye-opening for her: “They went through all of my expenses and saw how much money I made and how much money I could actually set aside for paying down debt and savings.”

Hopkins began treating her savings and debt like bills, putting a certain amount toward each every month. “I have discovered that I actually have a lot more money than I thought to do things like this,” she says.

And with her advisor holding her accountable, she now feels motivated to reach her financial goals. “It’s so helpful for me,” she says. “I have more in savings than I’ve ever had in my life. I had all this money that I was just letting go.”

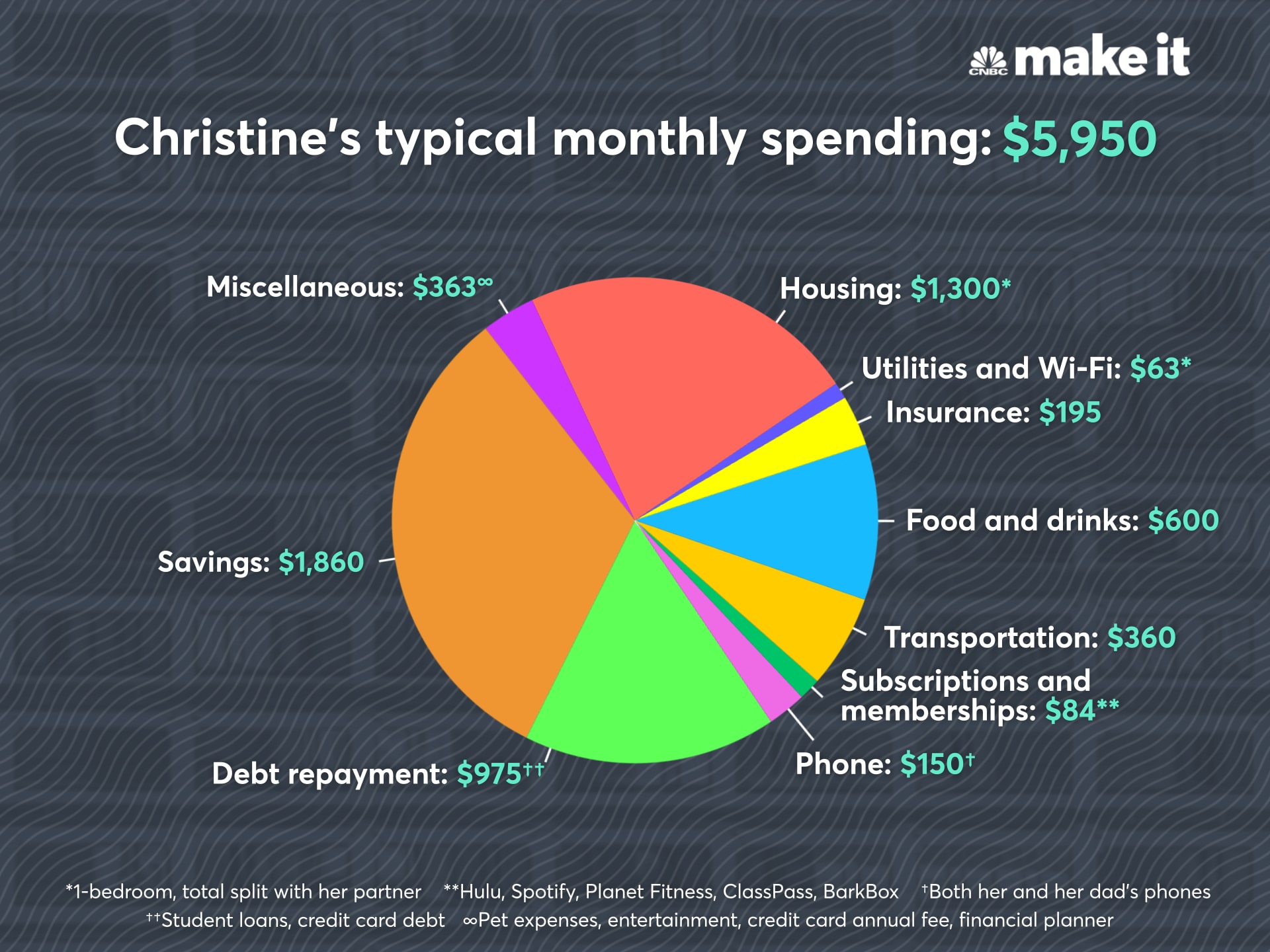

What she spends

Here’s a breakdown of everything Hopkins spends in a typical month.

Savings: $1,860

Hopkins has three savings accounts: one for emergencies, one for moving expenses and one for her dogs. Currently, she contributes $500 into her emergency fund, which has a balance of just over $4,000, and $1,000 into her travel and moving fund, which has nearly $2,000 in it.

Hopkins recently began diverting more money into her travel fund to help bulk it up. “I learned a couple of weeks ago that my partner and I are going to be moving to Germany for his post-doc,” she says. “I’m putting aside $1,000 a month to help with moving costs for that trip.”

The dogs’ savings account holds about $350 and is earmarked for any pet expenses, but Hopkins isn’t actively contributing to it while she saves up to move to Europe.

She also contributes 5% of her salary, about $360 per month, to her company-sponsored 401(k) plan, although her employer doesn’t provide any match. “I’ve been contributing since I had my first job out of undergrad,” she says.

Housing: $1,300

Hopkins splits a free-standing, one-bedroom house in Berkeley with her partner. Rent for the entire home is $2,250, and Hopkins pays $1,300. She contributes slightly more than her partner because she earned more while he was a PhD student.

Christine Hopkins (R) and her partner, Dylan.

Source: Christine Hopkins

Debt repayment: $975

Hopkins puts $260 per month toward paying off her student loans. She took out about $25,000 for her undergraduate degree and has around $17,000 left. She expects to have them paid off in full in six years. Hopkins attended the University of New Mexico, where she earned her BBA in business administration.

She contributes another $500 per month to her credit card debt. In total, she has about $11,000 left to pay off, although the amount has fluctuated over the years. “I’ll put a lot of money on [my credit card], then freak out about it and pay it down, then let it go back up.”

I have discovered that I actually have a lot more money than I thought.

She also took out a debt consolidation loan through a credit union, which allowed her to combine several of her credit card balances and pay them off at a lower interest rate. She pays $215 per month and has already paid off $1,000 of the $6,700 loan. “The credit card was at about 18% [APR], and this loan is closer to 6%,” she says.

Food and drinks: $600

Hopkins estimates that she and her partner spend around $100 per week on groceries, which they split evenly. In total, she personally puts about $200 toward groceries each month.

“I try to mostly cook at home,” Hopkins says. Much of her miscellaneous spending comes from dining out. She aims to spend around $100 a week, or $400 per month, on food and drinks, which includes weeknight meals, weekend brunches and meeting up with friends at bars and breweries.

Transportation: $360

To get to work every day, Hopkins takes a bus from Berkeley to San Francisco, which costs $5.50 each way, or about $11 per day. Over the course of a month, she spends around $220 total on public transportation. The system doesn’t offer discounts for frequent commuters, but Hopkins’s job allows her to use pre-tax dollars for transportation costs, which saves her a bit of money.

Hopkins and her partner share a moped-style scooter, which is a cost-effective way for them to get around. The scooter’s tank only holds a single gallon of gas, which they fill up a few times a month. In total, Hopkins only spends about $10 or less on gas. “It’s really cheap transportation,” she says.

Christine Hopkins and her partner, Dylan, with their shared scooter.

CNBC Make It

For weekend and evening plans, Hopkins will typically take a Lyft or use Gig, which is a service that provides on-the-spot car rentals. Customers can unlock any available Gig-branded car they see using an app on their phone. The app charges customers either by the minute or the distance, whichever is cheaper.

“We’ll use Gig when we’re trying to take the dogs somewhere, since one of ours won’t fit on the scooter,” Hopkins says. “We like to bring the dogs with us as often as possible.” That includes trips to friends’ houses, nearby parks and dog-friendly bars. She estimates she spends around $40 per month on Lyft and $90 on Gig.

Miscellaneous: $363

Hopkins spends $85 per month for a membership to the Financial Gym, where she meets with a financial planner. Together with her planner, Hopkins worked out a budget that allots her $200 per week for food, drinks, entertainment and other random expenses that come up. Of that $200, $150 goes toward food and drinks, which leaves her with $50 per week, or $200 per month, for anything else she chooses to buy, such as new clothes or movie tickets.

She spends about $40 per month on food for her two dogs. Their annual vet checkups run between $300 and $400 per year, which averages out to around $30 per month.

Hopkins’s two dogs, Barley and Ramsey.

CNBC Make It

Hopkins has five credit cards, but only one with an annual fee. It costs her $99 per year, or about $8 per month.

Insurance: $195

Hopkins pays $176 per month for health insurance, which includes dental and vision, offered through her job.

The couple splits their $30 renters insurance evenly. They also split an annual scooter insurance policy that costs $100 for the year. Hopkins’s contribution averages out to around $4 per month.

Phone: $150

Hopkins pays $150 per month for her cell phone bill, which also includes service and hardware for her dad’s phone. “Growing up, my parents weren’t the best with money,” Hopkins says. “My dad is struggling a little bit, and I’m in a situation where I can help him. It’s cheaper for us to be on one plan together, so I cover for him.”

Subscriptions and memberships: $84

Hopkins spends $10 per month for a membership to Planet Fitness, which is near her office in the city. She also puts $50 toward a ClassPass subscription, which allows her to take circus classes, such as aerial silks and handstands, at a studio near her home.

Hopkins became inspired to take circus-style classes after seeing people perform at Burning Man. “I thought it looked really cool and wanted to learn how to do it,” she says.

Hopkins (R) and a friend at Burning Man.

She contributes about $9 per month to a commercial-free Hulu plan that she shares with a few friends. She also pays $5 toward a shared Spotify Premium account.

For her two dogs, Hopkins subscribes to BarkBox, a service that sends monthly boxes filled with toys, treats and chew bones for dogs. She pays for an annual subscription that averages out to about $10 per month.

Utilities and Wi-Fi: $63

The monthly utility bill for gas and electricity runs around $80, and Wi-Fi costs another $45. Hopkins splits both expenses evenly with her partner, so her share comes to about $63 per month.

What the experts say

CNBC Make It asked Fred Egler, a certified financial planner at Betterment, to comment on where Hopkins is doing well and how she could improve. Here are his thoughts.

Fred Egler is a certified financial planner at Betterment.

Source: Betterment

She can pause saving for retirement to pay down debt

Hopkins is doing a great job tackling her credit card balances and student loan payments, Egler says. “From a budgeting perspective and from a goals perspective, the best thing she’s doing is paying down debt.”

Hopkins expects to pay her debt off in around six years, but she could make it happen more quickly, Egler says.

She should consider taking an even more aggressive approach by diverting her 401(k) contributions toward her debt. “Saving into your 401(k) is great. It’s a good vehicle for saving for retirement and it’s tax efficient. But if you’re not getting a match, it probably makes more sense to use that cash flow to pay down the debt a little bit more aggressively,” Egler says.

Because Hopkins isn’t earning any “free money” from her 401(k), her high-interest debt is likely costing her more than her retirement savings are earning. In general, any debt with an interest rate greater than 5% should be prioritized over other financial goals, Egler says.

Her consolidation loan could save her thousands

Hopkins made a smart decision consolidating a bunch of her debt and paying it off at a lower interest rate. “She’s going to save a lot of money on interest over that time period, even if it takes three-and-a-half or four years to wipe away that debt,” Egler says.

From a budgeting perspective and from a goals perspective, the best thing she’s doing is paying down debt.

Fred Egler

CFP at Betterment

Interest can add hundreds or thousands to your balance over time. By reducing her rate from 18% to 6%, Hopkins will save $1,000 or more over the life of the loan.

She’s smart to prioritize her emergency fund

Although paying down her debt should be Hopkins’s No. 1 priority, she’s smart to contribute to her emergency fund as well, Egler says.

“If something happens to you — you lose your job or you have an unexpected medical expense — not having that emergency fund established will just spiral your debt repayment plan, because the next place that you would look for money for those unexpected expenses would be a credit card,” Egler explains.

By making a point to put money away now, Hopkins will be covered if something comes up in the future, without having to rely on credit.

Christine Hopkins (second from L) and friends.

Source: Christine Hopkins

If she continues to put in $500 per month, Hopkins should have between $10,000 and $12,000 saved up in a little over a year, which is around three months’ worth of living expenses. “Once she has that emergency fund established, she can devote even more cash to paying down the debt,” Egler says.

She should monitor her accounts when she moves to Germany

As Hopkins gears up to relocate with her partner to Germany, it’s important that she continues to build her moving fund, Egler says. Unexpected costs happen with every move, so she’ll want to be prepared with as much cash as possible.

In addition to saving up enough to cover unforeseen expenses, Hopkins should also check in with her bank and 401(k) administrator to review their policies for having open accounts while living overseas. “Some businesses may not let you keep the 401(k) there if you live outside of the country,” Egler warns.

If it turns out that she does need to move her 401(k) somewhere else, she can roll it over into a Roth IRA or traditional IRA. That way, “it’s still invested and still working for her toward retirement, even if she might not be actively contributing to it,” Egler says.

Working with a professional is a wise move

Bringing in a professional can be a worthwhile expense, especially when you’re trying to tackle debt or other goals, Egler says. “It can be kind of daunting to figure out: How am I going to pay this mountain of debt off while still being able to live my life?” he says.

Christine Hopkins (R) and her partner, Dylan.

Source: Christine Hopkins

A qualified professional can help put things into perspective and break down your goals into actionable steps. But it’s crucial to make sure it’s someone you trust. Start by looking for an advisor who is a fiduciary, which means they have a legal duty to act in your best interest.

Overall, Hopkins is doing a good job focusing on her goals and taking steps to get her finances in order. “As long as she’s sticking to this budgeting plan of paying down the debt — which it seems like she is — she’s in a great spot,” Egler says. “She’s going to be financially free pretty soon.”

Editor’s Note: For clarity, all numbers are rounded to the nearest dollar.

What’s your budget breakdown? Share your story with us at makeitcasting@nbcuni.com for a chance to be featured in a future installment. We are especially interested in hearing from people in Washington, D.C., Atlanta and Nashville in the U.S., and Copenhagen, Denmark.

Like this story? Subscribe to CNBC Make It on YouTube!

Don’t miss: The budget breakdown of a couple who lives ‘comfortably’ on $200,000 a year in San Francisco

College Dorm and Apartment Cooking gadgets - if you change the sort settings on the Amazon page, it will show other items by price

College Dorm and Apartment Cooking gadgets - if you change the sort settings on the Amazon page, it will show other items by price

Source link